Data analysis has evolved beyond basic reporting, and today’s businesses demand more advanced techniques to gain deeper insights and make better decisions. Two such powerful tools in the data analyst’s arsenal are What-If Analysis and Forecasting, which can be implemented effectively using Power BI.This article will provide an in-depth guide to these techniques, offering a comprehensive understanding of their application and value in enhancing your data analysis capabilities.

Through detailed explanations, practical examples, and a step-by-step guide, you’ll learn how to implement these features in Power BI to unlock new perspectives from your data.By the end, you should be well-equipped to start utilizing these advanced analysis techniques in your own projects, improving your data-driven decision-making processes and taking your analytics skills to the next level.

What is What-If Analysis?

What-If Analysis is a technique used to explore how changes in input values impact the outcome of a model or calculation. It involves adjusting input variables to observe the resulting changes in output, allowing analysts to assess the sensitivity of a model to different scenarios.This technique is particularly useful when you want to understand the potential impact of specific changes or when you need to make decisions based on uncertain future events. By adjusting input values, you can simulate different scenarios and gain insights into how your data might behave under various conditions.

Example: Budget Planning

Imagine you’re a financial analyst for a company planning its annual budget. You have a Power BI report that calculates the company’s profitability based on various factors such as sales revenue, cost of goods sold, operating expenses, and tax rates.With What-If Analysis, you can adjust these input factors to answer questions like:

- What if sales increase by 10% next quarter?

- How would a 5% reduction in operating expenses impact our profitability?

- If tax rates change next year, what would be the potential impact on our bottom line?

By performing What-If Analysis, you can simulate these scenarios and gain valuable insights to make more informed budget decisions.

Implementing What-If Analysis in Power BI

Power BI provides a dedicated What-If parameter tool, allowing analysts to quickly and easily perform this type of analysis. Here’s a step-by-step guide to implementing What-What-If Analysis in Power BI:

Step 1: Prepare Your Data Model

Ensure your data model is well-structured and includes all the relevant measures and dimensions needed for your analysis. In the budget planning example, this might include measures for sales revenue, costs, expenses, and profitability, as well as dimensions like time periods and departments.

Step 2: Create What-If Parameters

Go to the Modeling tab in Power BI Desktop and select “What-If Parameter.” Here, you can create a new parameter by specifying a name, the data type (number, date, etc.), and the current value. For instance, you might create a parameter called “Sales Increase” with a data type of “Whole number” and a current value of 0.

Step 3: Adjust Measures with Parameters

Open the measure you want to adjust with the parameter. In the formula bar, you can reference the parameter value using square brackets. For example, to calculate sales revenue with a potential increase, you might adjust the measure formula as follows:

= [Sales Revenue] * (1 + [Sales Increase] / 100)

This formula multiplies the original sales revenue by 1 plus the percentage increase specified by the parameter.

Step 4: Create Visualizations

With the adjusted measures in place, create visualizations that showcase the impact of changing parameter values. For instance, create a line chart that plots profitability against different sales increase scenarios.

Step 5: Explore Scenarios

Now, the fun part begins! Adjust the parameter values to explore different what-if scenarios. Using the example above, you can change the “Sales Increase” parameter to 10% and observe how this impacts profitability. You can create buttons or slicers to allow users to easily toggle between different scenarios.

Benefits of What-If Analysis

What-If Analysis offers several advantages to data analysts and decision-makers:

- Improved Decision Making: By simulating different scenarios, analysts can provide valuable insights to decision-makers, helping them understand the potential outcomes of their choices and make more informed decisions.

- Risk Assessment: This technique allows businesses to assess the potential impact of risks and uncertainties, helping them develop contingency plans and mitigate potential threats.

- Strategic Planning: What-If Analysis enables organizations to explore different strategic paths and assess their potential outcomes, facilitating long-term strategic planning and goal setting.

- Sensitivity Analysis: By understanding how changes in input values affect outcomes, businesses can identify which factors have the most significant impact and focus their efforts on optimizing those areas.

Best Practices for What-If Analysis

To get the most out of What-If Analysis, consider the following best practices:

- Define Clear Scenarios: Ensure the scenarios you create are realistic and relevant to your business context. This will make the analysis more meaningful and actionable.

- Involve Stakeholders: Engage key stakeholders in the process to ensure the analysis aligns with their needs and priorities. This helps in gaining buy-in and ensuring the insights are utilized effectively.

- Visualize Impact: Use visualizations effectively to showcase the impact of changing scenarios. This could include charts, tables, or even Power BI’s built-in What-If tool, which allows users to adjust parameters and instantly see the results.

- Document Assumptions: Clearly document any assumptions made during the analysis, ensuring transparency and enabling others to replicate or understand your work.

What is Forecasting?

Forecasting is a statistical technique used to predict future outcomes or trends based on historical data. It involves analyzing past patterns and using mathematical models to project those patterns into the future, providing estimates for unknown or future data points.Forecasting is widely used in various industries, from sales and demand forecasting to financial market predictions and weather forecasting. It helps businesses make informed decisions, plan resources, and stay ahead of the competition by anticipating future needs and trends.

Example: Sales Forecasting

A retail company wants to forecast its sales for the upcoming year to plan inventory levels and marketing strategies. By analyzing historical sales data, taking into account factors like seasonality, promotions, and economic trends, they can create a forecast model that estimates future sales.This forecast can then be used to optimize inventory management, allocate resources effectively, and develop data-driven marketing campaigns to maximize sales during key periods.

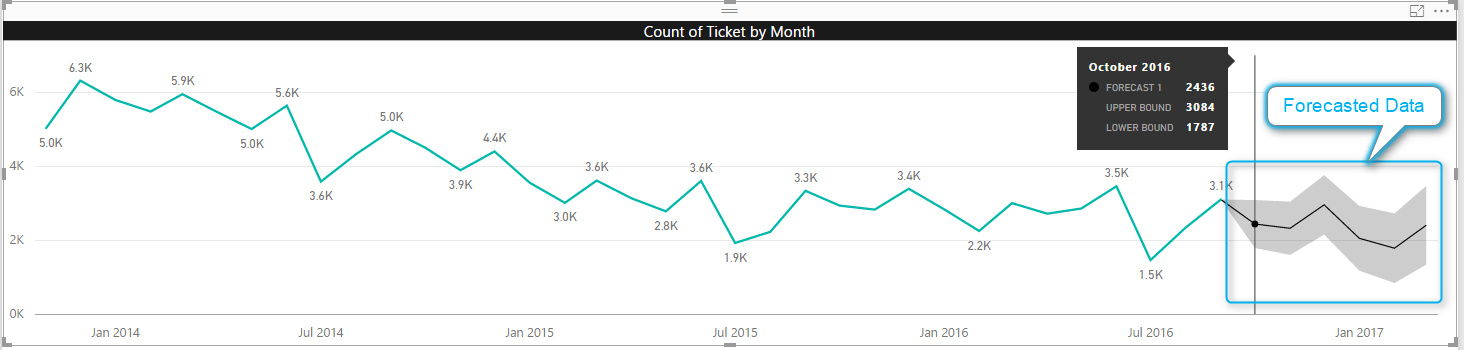

Implementing Forecasting in Power BI

Power BI offers built-in forecasting capabilities, making it easy to incorporate this technique into your data analysis. Here’s how you can implement forecasting in Power BI:

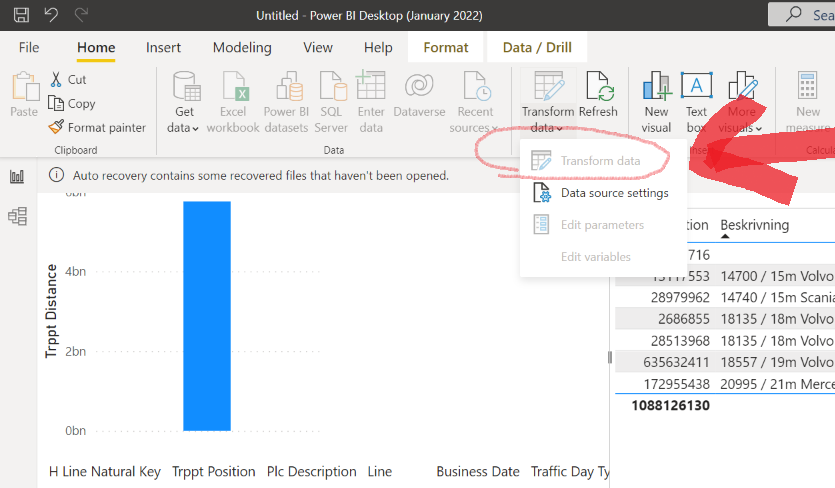

Step 1: Prepare Your Data

Ensure your data is clean and structured appropriately for forecasting. This includes addressing missing values, outliers, and ensuring your data is time-based, with a clear chronological order.

Step 2: Create a Forecast Measure

In the Power BI Desktop, go to the Modeling tab and select “Forecast.” This will open the Forecast dialog box.

Step 3: Specify the Forecast Settings

In the Forecast dialog, you’ll need to define the following:

- Analysis: Choose whether you want to forecast based on a time-based or non-time-based analysis. For most cases, you’ll select “Forecast by date.”

- Value: Select the measure you want to forecast, such as sales, revenue, or units sold.

- Date: Choose the date field that represents the time dimension in your data.

- Forecast length: Specify how many future periods you want to forecast.

- Seasonality: If your data exhibits seasonal patterns (e.g., monthly or quarterly cycles), you can specify the seasonality here.

Step 4: Review the Forecast

Once you’ve defined the settings, Power BI will generate a forecast model and display a preview of the forecasted values. You can review this preview to assess the accuracy of the forecast.

Step 5: Create Visualizations

With the forecast measure in place, create visualizations to showcase the predicted values. This could include line charts that plot historical data against the forecast or tables that display the forecasted values for specific periods.

Benefits of Forecasting

Implementing forecasting in your data analysis offers several advantages:

- Data-Driven Decision Making: Forecasting provides valuable insights into future trends, helping businesses make more informed decisions about resource allocation, budgeting, and strategic planning.

- Improved Planning: By anticipating future needs, organizations can optimize their operations, ensuring they have the right resources in the right places at the right time.

- Cost Savings: Accurate forecasting can lead to significant cost savings by reducing waste, optimizing inventory levels, and improving efficiency.

- Competitive Advantage: Forecasting enables businesses to stay ahead of the competition by identifying future opportunities and potential risks, allowing them to respond proactively.

Best Practices for Forecasting

To ensure accurate and reliable forecasting, consider these best practices:

- Data Quality: Ensure your data is clean, consistent, and reliable. Address any data quality issues before running a forecast, as garbage in, garbage out.

- Understand Patterns: Take the time to understand the underlying patterns and trends in your data. Consider factors like seasonality, cyclicality, and potential outliers that might impact the forecast accuracy.

- Model Selection: Choose the appropriate forecasting model based on the characteristics of your data. Different models are suited to different scenarios, such as exponential smoothing for stable data or ARIMA for more complex time series data.

- Monitor and Update: Forecasts should be regularly monitored and updated to reflect changing conditions. As new data becomes available, reassess the accuracy of your forecast and adjust your models accordingly.

Combining What-If Analysis and Forecasting

What-If Analysis and Forecasting are powerful techniques on their own, but combining them can provide even deeper insights. By integrating these two approaches, you can assess the potential impact of different scenarios on your forecasted outcomes.For example, you could create a forecast model for sales revenue and then use What-If Analysis to explore how changes in marketing spend or product pricing might impact those forecasted sales. This allows you to not only predict future trends but also assess the sensitivity of your forecast to different variables.

Conclusion

What-If Analysis and Forecasting are invaluable tools for data analysts, offering a way to explore the potential impact of decisions and anticipate future trends. By implementing these techniques in Power BI, analysts can provide actionable insights to drive data-informed decision-making within their organizations.As you continue to enhance your data analysis capabilities, consider how these advanced techniques can be applied to your specific use cases. Experiment with different scenarios, visualize the impact, and always remember to communicate your findings effectively to stakeholders, ensuring that your insights lead to tangible outcomes.

How might the combination of What-If Analysis and Forecasting help organizations make more robust and resilient decisions, especially in uncertain or rapidly changing environments?Feel free to share your thoughts and experiences in the comments, and let’s continue the discussion on harnessing the power of advanced data analysis techniques!